Positions at Harley-Davidson (Retired 2010):

President & Chief Operating Officer 2001 - 2009

Various senior executive positions 1992 - 2001

Other Manufacturing Company Positions:

Manufacturing and Engineering executive JI Case (agricultural equipment) 1989 - 1992

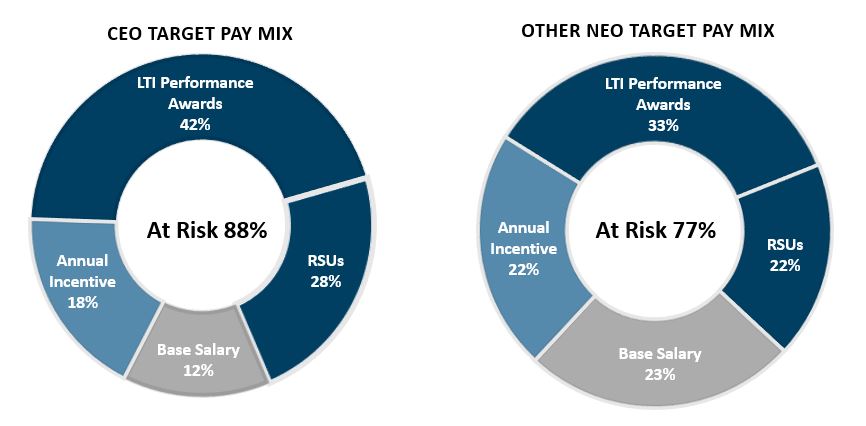

Manufacturing and Quality executive Active Engagement with our Shareholders Our Board and management team greatly value theour shareholders' opinions and feedbackfeedback. Our proactive, year-round shareholder engagement process includes an annual shareholder outreach program, conducted in the fall and winter, and our investor communication program, consisting of our shareholders, which is why we have proactive, ongoing engagementmeetings and communications with our shareholders throughout the year focusedin various forums to encourage meaningful dialogue about topics of interest. The Board regularly receives reports of shareholder feedback from these programs for its consideration. More information on corporate governance, executive compensationour shareholder engagement efforts and corporate responsibility. This outreachthe Board's response is in addition to the ongoing communication between our shareholders and our Chairman & Chief Executive Officer, Vice President & Chief Financial Officer and Investor Relations team on AAM's financial performance and strategic objectives.provided throughout this proxy statement.  | | | | | | | | | | | | | | | | Investor Communication Program | | Board Involvement | | Annual Shareholder Outreach Program | | | | | Throughout the year | –•Senior management participation in conferences

–•One-on-one and group meetings

–Site visits•Events held at manufacturing facilities and technical centersAAM locations featuring innovations in technology/electrification

–•Day-to-day interaction with Investor Relations

| | | Annual Shareholder Outreach Program | Semi Annual | –•Fall/Winter outreach seeking engagement with shareholders and with proxy advisory firms

•Led by CFO and Investor Relations Department •Lead Independent Director/Compensation Committee Chair participates in and is available for outreach meetings | | | Board Involvement | Routine | –•Board considers shareholder feedback and shareholder vote in decision-making

–•Board reviews disclosure enhancements

| | –Fall/Winter engagement with shareholders and proxy advisory firms

–Led by CFO and Investor Relations Department

–•Board and management discuss shareholder feedback and the Board's response

|

Scope of Annual Shareholder Outreach Program | | | | | | | | | | We contacted | | Representing over | | | | | Over 25 of our top shareholders | | 70% of our outstanding shares |

Shareholder Engagement Topics | | | | | | | | | | | | | | | | | | | | | | | | | | | | Executive compensation programs | | Diversity, equity and inclusion initiatives | | Human capital management | | Board involvement in ESG programs | | Shareholder rights | | | | | | | | | | | Board refreshment and diversity | | Selection process for Board candidates | | Classified Board | | Separation of Chairman and CEO roles | | Board oversight of risk |

| | | | 2024 AAM Proxy Statement | 10

|

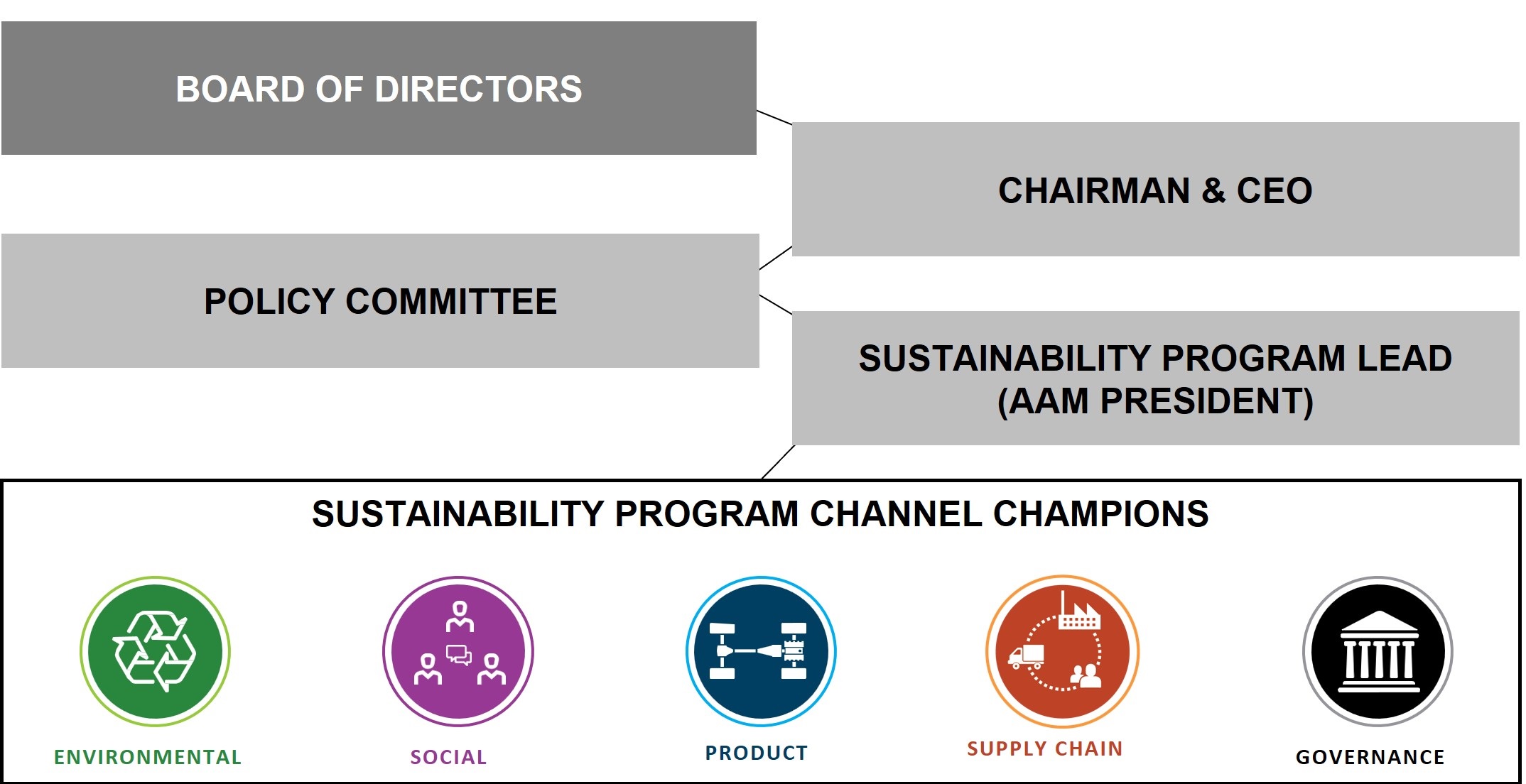

Sustainability Governance Governance of sustainability at AAM begins with our Board and moves through clearly established ownership responsibilities at multiple levels in the organization. The overall governance structure of AAM's Sustainability Program is depicted below.

| | | | 2024 AAM Proxy Statement | 11

|

Board Level Oversight and Board Committee Roles in Sustainability The Board and its committees play a critical role in overseeing AAM's Sustainability Program through effective and engaged oversight and is responsive to feedback from shareholders. Consistent with Board responsiveness with shareholder feedback, the Board holds senior leadership accountable for sustainability performance and reporting. The full Board receives quarterly sustainability updates from AAM's Sustainability Program Lead as an agenda item. Our Board committees oversee sustainability topics related to their areas of responsibility and provide regular updates to the full Board.

| | | | | | | | | | | | | | | | | | | | | | Audit Committee | | Nominating / Corporate Governance Committee | | Compensation Committee | | Technology Committee | | | | | | | | | Oversees policies and activities related to financial reporting, internal controls, risk management, cybersecurity, ethics and corporate compliance | | Oversees policies, strategies and performance related to sustainability matters, including DEI, human capital management and climate-related topics | | Structures executive compensation programs to drive performance aligned with our business strategy, including advancements in our Sustainability Program | | Oversees product technology, with a focus on advancements in electrification, light-weighting and other key product technologies |

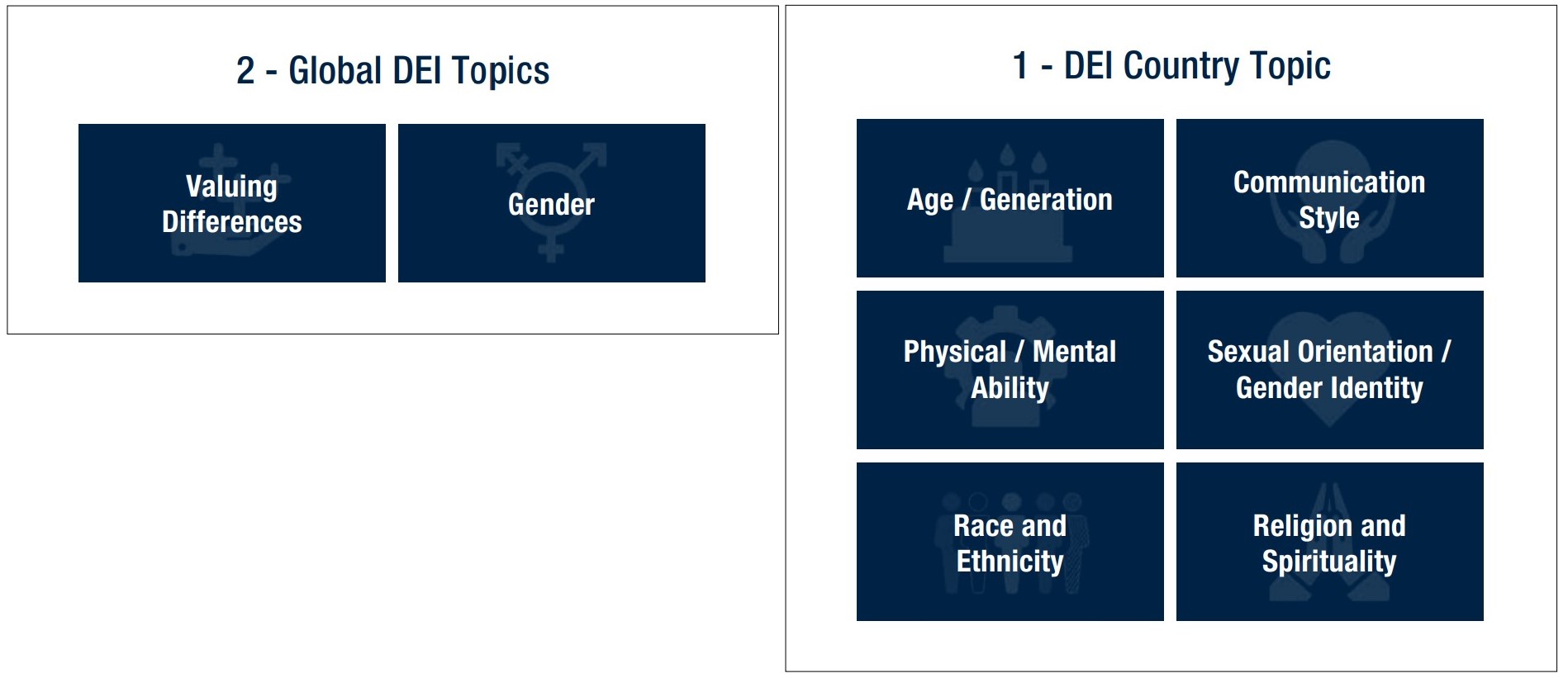

Board Engagement and Leadership Commitment to DEI The importance of DEI is evident in the ongoing commitment of AAM's Senior Executive Leadership team and oversight by our Board of Directors. Their active engagement and expectations set the tone at the top. In addition to quarterly DEI initiative updates, the Board reviews the metrics and results related to our 2030 demographic goals. A key element of our DEI approach is our DEI Strategic Roadmap. The five pillars of our Roadmap, described below, outline our path forward and include action plans and monitoring of results as we strive to continuously improve.

| | | | 2024 AAM Proxy Statement | 12

|

2030 Demographic Goals As part of our global DEI program, AAM established three global and four U.S. 2030 DEI goals. These goals are reviewed annually with our Board and shared with our global workforce. | | | | | | | | | | WOMEN | Global Goals | –Increase women representation to 25% in our global workforce –Increase women representation in our global leadership ranks to 25%

| | U.S. Goal | –Increase women representation to 30% in our U.S. workforce | | BIPOC * | Global Goal | –Increase BIPOC representation in our global leadership ranks to 30% | | U.S. Goal | –Increase BIPOC representation in our U.S. workforce to 22% | | BLACKS | U.S. Goals | –Increase the representation of black associates in our workforce to 10% –Increase the representation of black salaried associates to 6% | |

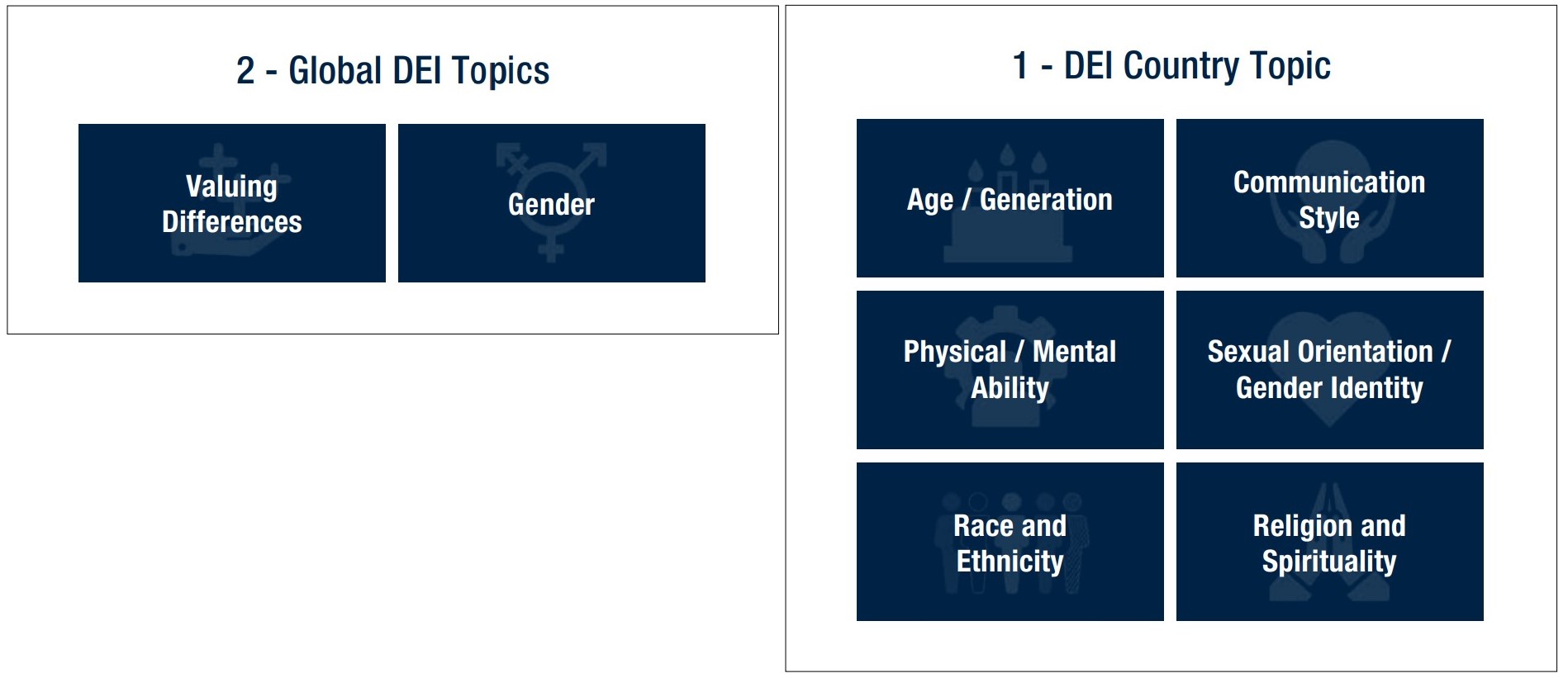

*BIPOC = Black, Indigenous and People of Color Global 2+1 DEI Program Our DEI strategy incorporates not only shared global goals but also provides flexibility for individual countries to incorporate their unique needs into the program. This approach helps foster an inclusive environment with meaningful impact at the local level. Our Global DEI 2+1 Program focuses on three goals (2+1): –Two goals based on AAM selected global topics; and –One additional goal based on each country's relevant topics. These +1 topics were identified based on learning and feedback from our facilities across the globe. | | | | 2024 AAM Proxy Statement | 13

|

2023 Sustainability Achievements

| | | | | | ENVIRONMENTAL

POWERING A GREENER FUTURE | SOCIAL

POWERING AN INCLUSIVE FUTURE |

–Exceeded our 2023 U.S. renewable energy goal

–Established a biodiversity partnership with the Wildlife Habitat Council

–Achieved ISO 50001 certification at all our manufacturing facilities

|

–Expanded DEI Steering Committee structure to include regions and countries

–Completed 16 labor negotiations globally without disruption to operations

–Achieved 22,000+ consolidated days without a recordable safety incident

| PRODUCT

POWERING A CLEANER FUTURE | SUPPLY CHAIN

POWERING A COLLABORATIVE FUTURE |

–Recognized as a 2023 Automotive News PACEpilot program finalist

–Launched 14 major global product programs

–Received 21 quality performance awards

|

–Released a new Supplier Code of Conduct

–Launched a global transportation campaign to reduce emissions

–Increased our supplier diversity spend year-over-year by 12% |

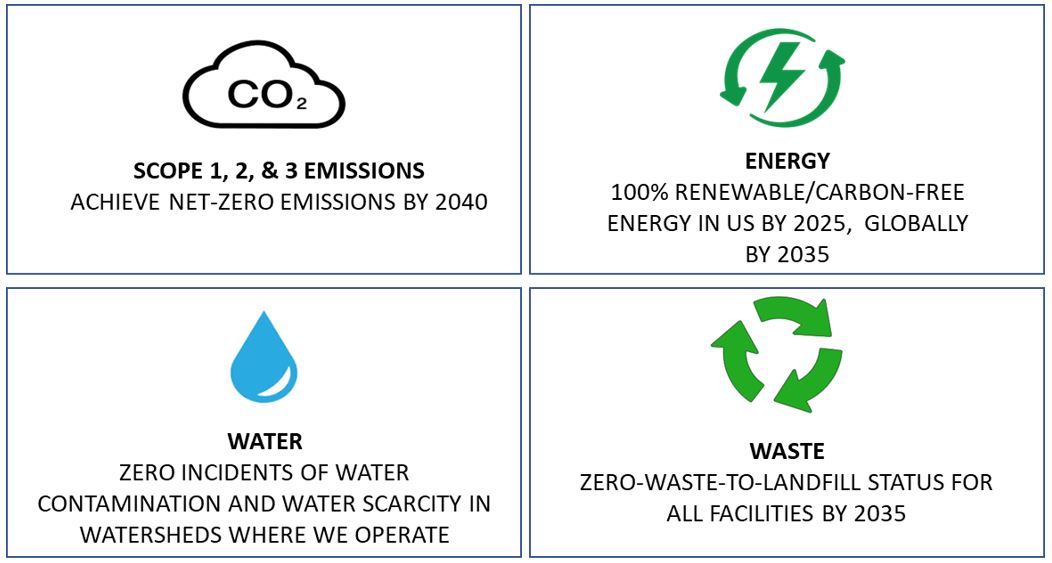

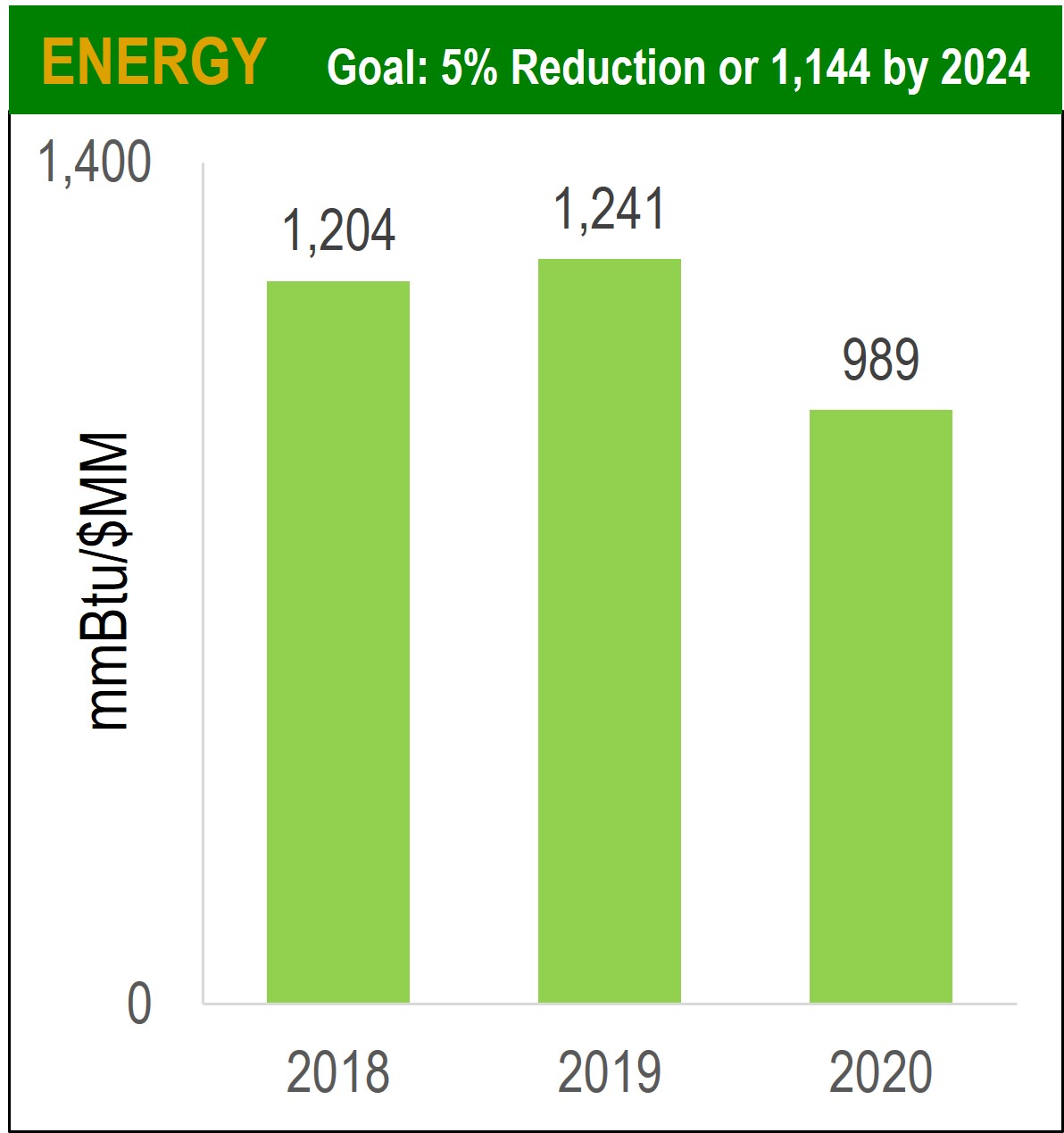

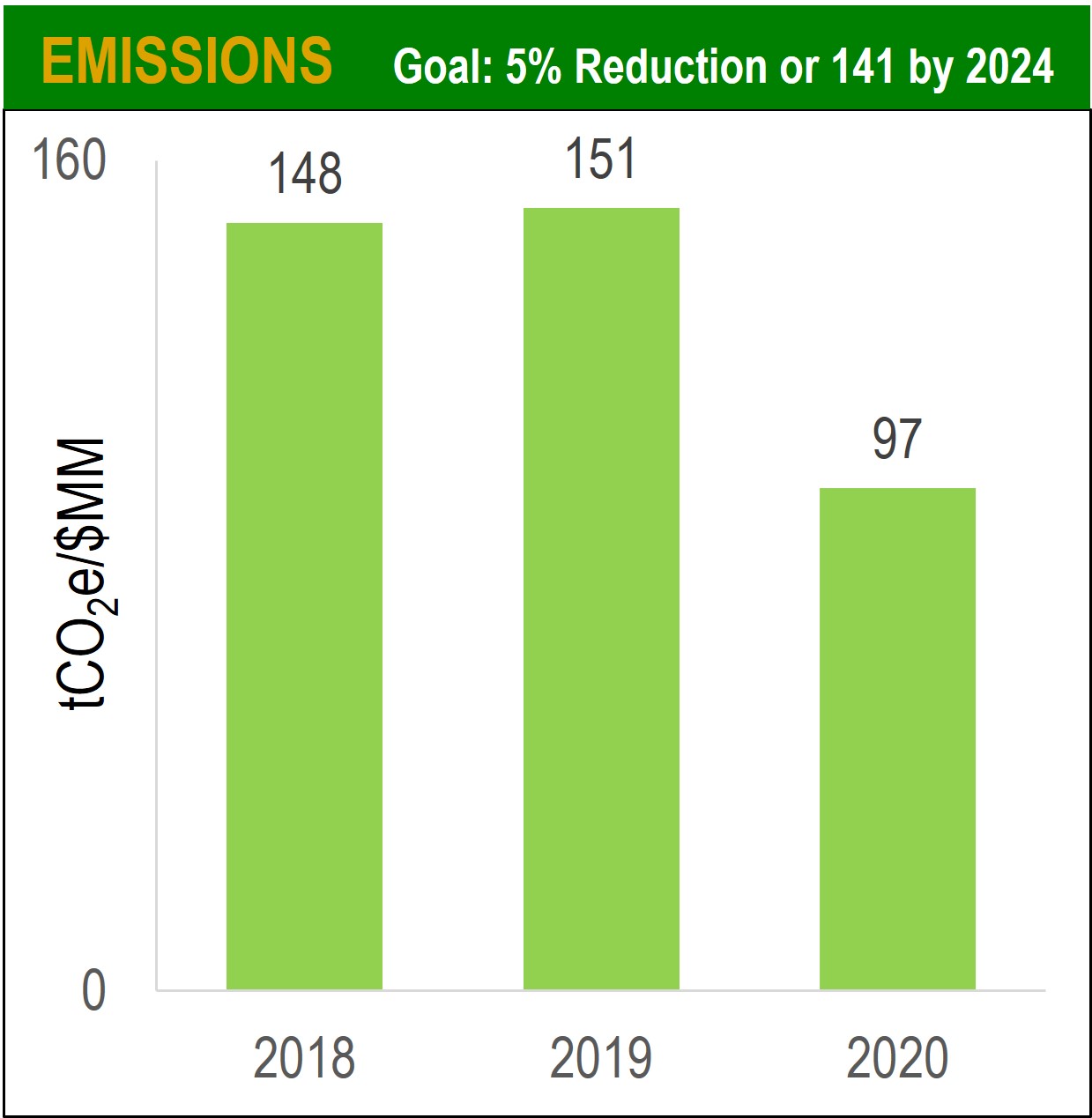

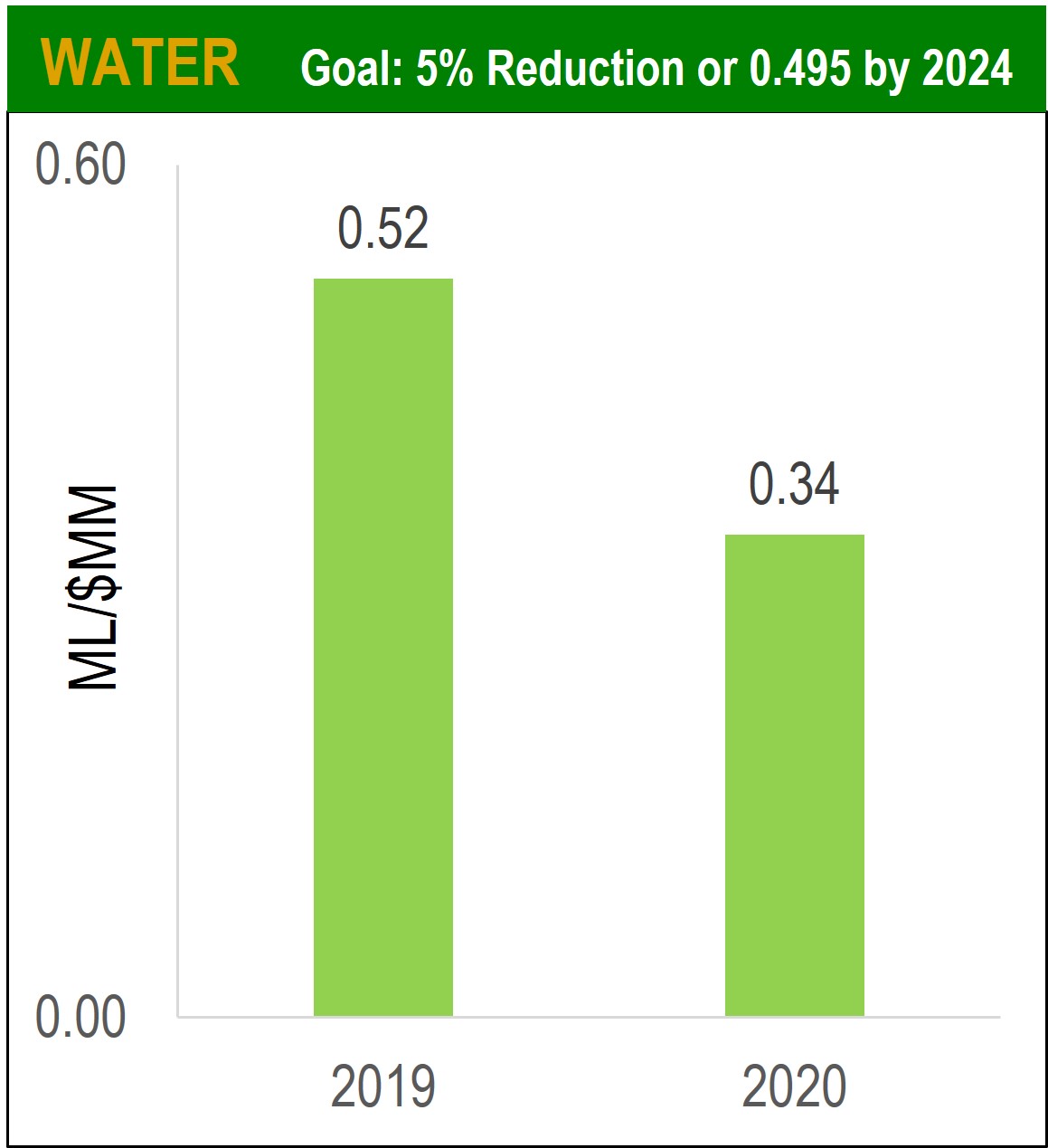

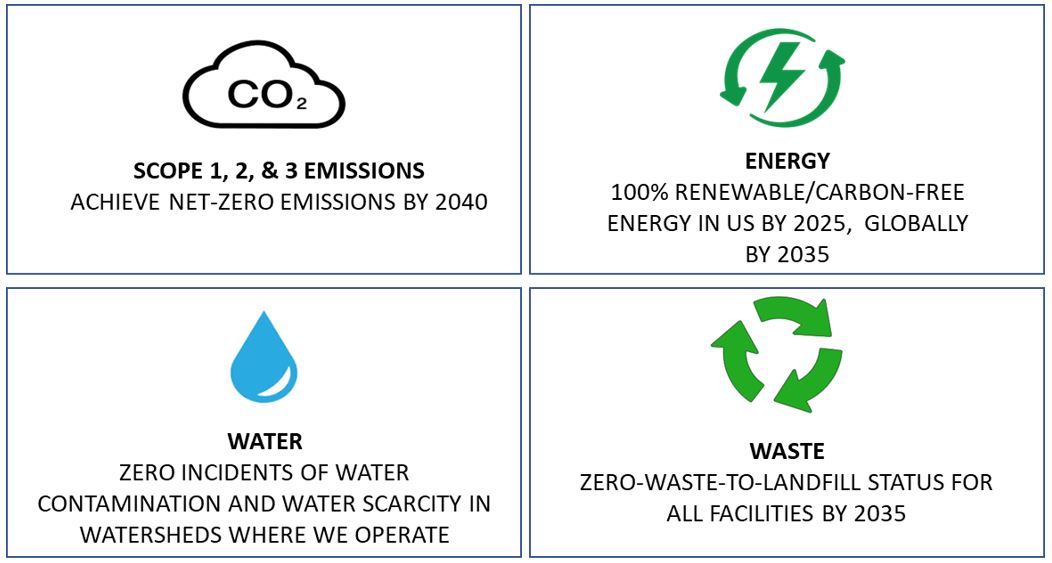

ENVIRONMENTAL GOALS

| | | | 2024 AAM Proxy Statement | 14

|

Election of Directors | | | | Proposal 1: Election of Directors |

The Board proposes that David C. Dauch, William L. Kozyra, Peter D. Lyons, and Samuel Valenti III be re-elected to the Board as Class I directors for terms expiring at the annual meeting in 2027. The Board is divided into three classes. Directors serve for staggered three-year terms. The Board believes that the staggered election of directors helps to maintain continuity and stability and ensures that a majority of directors at any given time will have in-depth Company knowledge. This is important as the Company continues to navigate the automotive industry's electrification transformation with capital intensive products and programs that require long-lead investments and stable relationships with our customers. The Board unanimously approved the nominations of Mr. Dauch, Mr. Kozyra, Mr. Lyons, and Mr. Valenti based on their demonstrated effectiveness as members of our Board and the committees on which they serve, their experience and expertise, and their sound judgment and integrity. Each nominee brings a strong and unique background and set of skills to the Board. Collectively, the Board has high levels of competence and experience in a variety of areas, including manufacturing, engineering, finance, international business, management, law, risk management, strategic business development and the global automotive industry. A summary of the principal occupation, professional background and specific knowledge and expertise that qualify each nominee to serve on our Board is provided in the following pages of this proxy statement. | | | | | | | þ | The Board unanimously recommends a vote FOR each of the nominees. |

Director Candidate Evaluation and Recruitment Our Board believes that the most effective oversight comes from a Board that represents a diverse range of experience and perspectives that provide the collective skills, qualifications and attributes necessary to provide sound governance. To carry out its responsibilities and set the appropriate tone at the top, our Board is focused on the character, integrity and qualifications of its members, and on the Board's leadership structure and composition. The Nominating/Corporate Governance Committee reviews with the Board the experience and attributes desired for effective governance in our changing industry and evaluates the current Board composition in light of these criteria. Although specific qualifications may vary from time to time, desired qualities and characteristics include: –high ethical character and shared values with AAM; –high-level leadership experience and achievement at a policy-making level in business, educational or professional activities; –breadth of knowledge of issues affecting AAM; –special competencies, such as financial, technical, international business or other expertise, or industry knowledge; –awareness of a director's vital role in AAM's good corporate citizenship and corporate image; and –sufficient time and availability to effectively carry out a director's duties. The Board as a whole should reflect a balance of knowledge, experience, skills, expertise and diversity that, when taken together, will enhance the quality of the Board’s deliberations and decisions. Consistent with this philosophy, the Board adopted a policy to include in each director search qualified candidates who reflect diverse backgrounds, including diversity of gender and race. Board composition reflects the Board's commitment to identify, evaluate and nominate candidates who possess personal qualities, qualifications, skills, and diversity of backgrounds, and provide a mix of tenures that, when taken together, best serve our company and our shareholders. Diversity in tenure creates a good mix of perspectives. Longer-tenured directors bring a deep understanding of the Company and continuity as new directors join the Board. Newer members bring new perspectives, expertise and diversity as the Board is refreshed to address changes in the business over time. In addition, for incumbent directors, the Nominating/Corporate Governance Committee and the full Board considers attendance, past performance on the Board and contributions to the Board and applicable committees. In identifying new director candidates for the Board, the Nominating/Corporate Governance Committee, in consultation with the Chairman of the Board, makes recommendations to the Board based on referrals from Board members and other appropriate sources. Once a proposed candidate is identified, their skills, qualifications and independence are evaluated and individuals meeting the Board’s criteria are interviewed by the Chairman of the Nominating/Corporate Governance Committee and other Board members, as appropriate. The Nominating/Corporate Governance Committee then conducts all necessary and appropriate inquiries into the candidate's background and qualifications, reviews the candidate’s skills, qualifications and independence, and considers feedback from the interviews in deciding whether to recommend that the Board consider appointing the candidate to the Board.

The Nominating/Corporate Governance Committee is also open to accepting stockholders' suggestions of candidates to consider as potential Board members as part of the Nominating/Corporate Governance Committee's periodic review of the size and composition of the Board and its committees. The Nominating/Corporate Governance Committee uses the same robust process to evaluate director nominees recommended by stockholders as it does to evaluate nominees identified by other sources. Please note the requirements summarized in the 2025 Stockholder Proposals and Nominations section of this proxy statement may apply.

As part of the Board’s commitment to Board refreshment, the Board actively identified and evaluated several potential new Board members. Interviews were conducted by our Chairman and CEO, Lead Independent Director and Chair of the Nominating & Governance Committee, and other Board members. The Nominating/Corporate Governance Committee considered feedback from this process and, ultimately, recommended to the full Board that Aleksandra Miziolek be appointed to the Board. The Board appointed Ms. Miziolek effective March 15, 2024, joining the class of directors with a term expiring at the 2025 Annual Meeting of Shareholders.

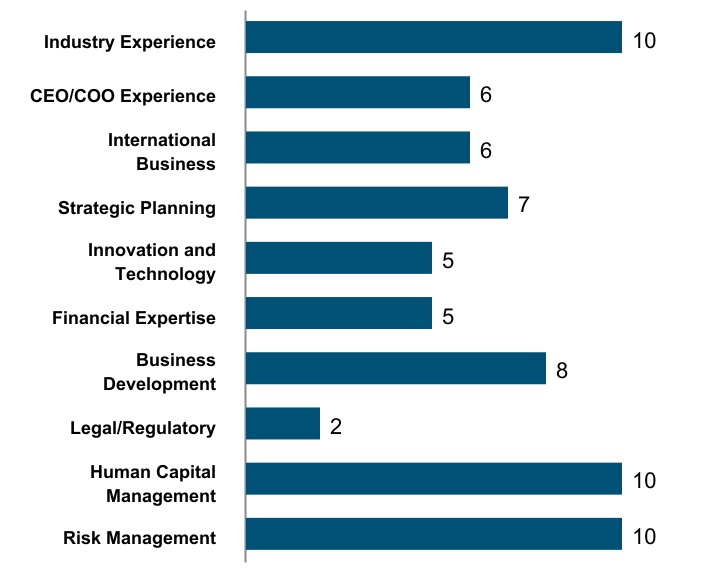

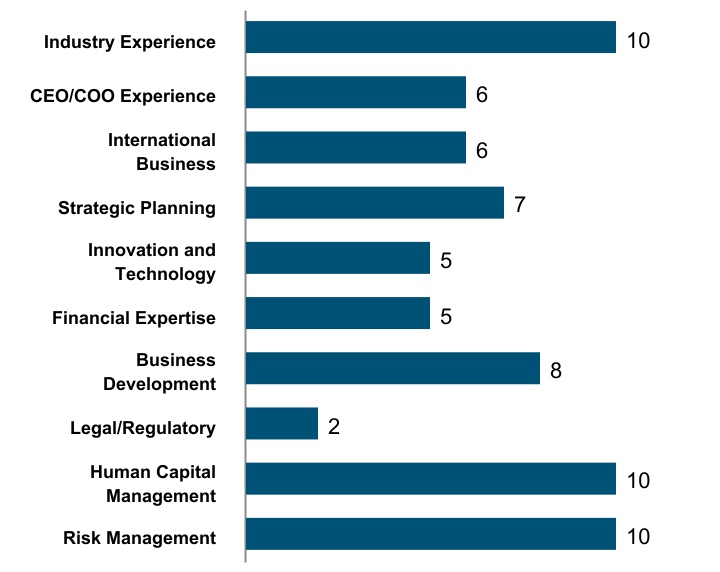

Board Skills and Qualifications The following table summarizes the key qualifications and skills of our Board members that are directly relevant to our business and strategic objectives. The director biographies listed below describe further details about the qualifications and relevant experience of each director nominee and returning director. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Skill / Qualification | David C.

Dauch | Elizabeth A.

Chappell | William L.

Kozyra | Peter D.

Lyons | James A.

McCaslin | William P.

Miller II | Aleksandra A. Miziolek | Herbert K.

Parker | Sandra E.

Pierce | John F.

Smith | Samuel

Valenti

III | | Industry Experience | n | n | n | n | n | n | n | n | n | n | n | | CEO/COO Experience | n | n | n | | n | | | | n | | n | | International Business | n | | n | n | n | n | n | n | | n | | | Strategic Planning | n | n | n | n | | | n | n | n | n | n | | Innovation & Technology | n | n | n | | n | n | | | | n | | | Financial Expertise | | | | | | ¢ | | ¢ | n | ¢ | n | | Business Development | n | n | n | | n | | n | n | n | n | n | | Legal/Regulatory | | | | n | | n | n | | | | | | Human Capital Management | n | n | n | n | n | | n | n | | | n | | Risk Management | n | n | n | n | n | n | n | n | n | n | n | | | | | | | ¢ | Audit Committee financial expert under SEC rules |

Nominees for Director Class I — Directors to hold office until the 2027 Annual Meeting of Stockholders | | | | | | | | | | David C. Dauch | Chairman of the Board & Chief Executive Officer, AAM | | | | | Current and Past Positions at AAM | Key Qualifications and Experience | Chairman of the Board

since August 2013

Chief Executive Officer

since September 2012

President & Chief Executive Officer

September 2012 - August 2015

President & Chief Operating Officer

2008 - 2012

Various positions of increasing responsibility

1995 - 2008 | Based on his professional background and prior AAM Board experience, the following qualifications led the Board to conclude that Mr. Dauch should serve on AAM's Board: his leadership experience as an officer of AAM since 1998; the breadth of his management experience within, and knowledge of, AAM's global operations; and his subject matter knowledge in the areas of innovation and technology, manufacturing, strategic planning, human capital management and risk management. | | | | | | Directorships (not-for-profit)

and Leadership Roles | Age:59 | Other Company Directorships | –Business Leaders for Michigan –Detroit Economic Club –Detroit Regional CEO Council, Regional Chamber and Regional Partnership –Great Lakes Council Boy Scouts of America –Boys & Girls Club of Southeastern Michigan –National Association of Manufacturers (NAM) –Miami University Business Advisory Council –Stellantis Supplier Advisory Council | Director Since: 2013 (Chairman) 2009 | Amerisure Companies since 2014

| | Previous Directorship | | Horizon Global Corporation

2015 - 2018 | | Committees: | | Executive (Chairman) | | | | | | Previous Directorships (not-for-profit) | | | –General Motors Supplier Council –Original Equipment Suppliers Association (OESA) –Detroit Mayor's Workforce Development Board –Sustainability Leadership Council of Michigan |

| | | | | | | | | | William L. Kozyra | Chairman & Chief Executive Officer, Wilko Plastics, Inc. | | | | | Current and Past Positions (BF) | Key Qualifications and Experience | Chairman & Chief Executive Officer

Wilko Plastics, Inc. since 2022

President & Chief Executive Officer

TI Fluid Systems plc (TI Automotive) (fluid storage, carrying and delivery systems)

2008 - December 2021

President & Chief Executive Officer

Continental AG North America

1998 - 2008

Member of Executive Board

Continental AG (DAX)

2006 - 2008

Vice President & General Manager

Brake Products Division of

Bosch Braking Systems

1995 - 1997 | Based on his professional background and prior AAM Board experience, the following qualifications led the Board to conclude that Mr. Kozyra should serve on AAM's Board: his leadership experience as Chief Executive Officer of TI Fluid Systems plc; the breadth of his international experience with global companies in the automotive industry; and his subject matter knowledge in the areas of engineering, OEMs, manufacturing, innovation and technology, strategic planning, human capital management and risk management. | | | | | | | Age:66 | Former Public Company Directorship | Directorships (not-for-profit)

and Leadership Roles | Director Since: 2015 | | Committees: | TI Fluid Systems plc (TI Automotive)

2008 - December 2021 | –General Motors Supplier Council –Ford Motor Company Top 100 Supplier Forum –Notre Dame Preparatory School –Automotive Hall of Fame –Boy Scouts of America, Detroit –University of Detroit Alumni Council –Society of Automotive Engineers | | Compensation | | Nominating/Corp Gov | | Technology | | | | |

| | | | | | | | | | Peter D. Lyons | Counsel, Freshfields Bruckhaus Deringer US LLP | | | | | Current and former Positions | Key Qualifications and Experience | Counsel since 2021 Partner 2014 - 2021 Freshfields Bruckhaus Deringer US LLP New York, NY

Adjunct Professor since 2020 University of Virginia, School of Law | Based on his professional background and prior AAM Board experience, the following qualifications led the Board to conclude that Mr. Lyons should serve on AAM's Board: his experience as an attorney of major law firms since 1980; the breadth of his experience in advising global businesses on complex legal matters and transactions; and his subject matter knowledge in the areas of corporate governance, mergers and acquisitions, international business, human capital management and risk management. | | | | | | | Age: 68 | | | Director Since: 2015 | | | Committees: | | | Compensation | | | Nominating/Corp Gov | |

| | | | | | | | | | Samuel Valenti III | Chairman & Chief Executive Officer, Valenti Capital LLC | | | | | Current and Past Positions | Key Qualifications and Experience | Chairman & Chief Executive Officer Valenti Capital LLC since 2000

Positions at Masco Corporation 1968-2008 President, Masco Capital Corporation 1988-2008

Vice President - Investments Masco Corporation 1974-1998 | Based on his professional background and prior AAM Board experience, the following qualifications led the Board to conclude that Mr. Valenti should serve on AAM's Board: his leadership experience as an executive of Masco for 40 years; the breadth of his management experience in diversified manufacturing businesses; and his subject matter expertise in the areas of strategic planning, finance, economics and asset management, human capital management and risk management.

| | | | | | | Age: 78 | Other Public Company Directorship | Directorships (not-for-profit)

and Leadership Roles

| Director Since: 2013 | TriMas Corporation since 2002 | | Committees: | Previous Directorships | –Business Leaders for Michigan –Renaissance Venture Capital Fund (Michigan) Advisory Board Chairman

| | Audit | Horizon Global Corporation 2015 - May 2018 Masco Capital Corporation 1988 - 2008 | | Compensation | | Nominating/Corp Gov |

Returning Directors Class II— Directors to hold office until the 2025 Annual Meeting of Stockholders | | | | | | | | | | Elizabeth A. Chappell | Former President & Chief Executive Officer, Detroit Economic Club | | | | | Current and Past Positions | Key Qualifications and Experience | Former Owner (co-founder) RediMinds, Inc. 2015 - 2019 President & Chief Executive Officer Detroit Economic Club 2002 - 2017 Executive Vice President, Corporate Communications & Investor Relations Compuware Corporation 1997 - 2001 President & Chief Executive Officer Chappell Group 1995 - 2000 Various executive positions with increasing responsibility with AT&T for 16 years | Based on her professional background and prior AAM Board experience, the following qualifications led the Board to conclude that Ms. Chappell should serve on AAM's Board: her leadership experience as President & CEO of the Detroit Economic Club; the breadth of her community outreach and corporate citizenship experience in her professional, civic and charitable endeavors; and her subject matter knowledge in the areas of investor relations, marketing and communications, business development, human capital management and risk management. | | | | | | | Directorships (not-for-profit) and Leadership roles | Age: 66 | Previous Directorships | –Detroit Economic Club –Detroit Zoo –Michigan Israel Business Accelerator (MIBA) –The Parade Company –International Women's Forum | Director Since: 2004 | Handleman Company 1999 - 2009

Compuware Corporation 1997 - 2002

| | Committees: | | Nominating/Corp Gov | | (Chair) | | Technology |

| | | | | | | Corporate GovernanceElection of Directors |

| | | | | | | | | | Aleksandra A. Miziolek | Retired Chief Transformational Officer, Cooper-Standard Holdings, Inc. | | | | | Current and Past Positions | Key Qualifications and Experience | Operator Advisor Assembly Ventures since 2021

Advisor OurOffice, Inc. since 2021

SVP, Chief Transformation Officer, General Counsel, Corporate Secretary and Chief Compliance Officer Cooper-Standard Holdings, Inc. 2014-2019

Member, Director of the Automotive Industry Group Dykema Gossett PLLC 1982-2014

| Based on her professional background and public company board experience, the following qualifications led the Board to conclude that Ms. Miziolek should serve on AAM’s Board: her leadership experience as SVP, Chief Transformation Officer, General Counsel, Corporate Secretary and Chief Compliance Officer for Cooper-Standard Holdings, Inc.; the breadth of her experience leading transformational initiatives and advising global businesses on complex legal issues in the automotive industry; and her subject matter knowledge in the areas of international business, mergers and acquisitions strategic planning, innovation, human capital management and risk management. | | | | | | Directorship (not-for-profit) and Leadership Roles | –Research Council of Michigan –International Women’s Forum Member –NACD Board Leadership Fellow –MiSide

| | Age: 67 | Public Company Directorships | Director Since: 2024 | Solid Power, Inc. since 2021

Exro Technologies, Inc. since 2023

| | | Previous Directorships | | Tenneco, Inc. 2020-2022 | | | | |

| | | | | | | | | | Herbert K. Parker | Retired Executive Vice President, Harman International Industries | | | | | Past Positions | Key Qualifications and Experience | Harman International Industries, Inc.: Executive Vice President, Operational Excellence 2015 - 2017

Executive Vice President and Chief Financial Officer 2008 - 2014

ABB, Inc. and related ABB companies: Chief Financial Officer, North America 2006 - 2008

Chief Financial Officer, Automation Technologies Division 2002 - 2005

Various finance positions of increasing responsibility throughout Asia, Europe and North America 1980 - 2002

| Based on his professional background and public company board and audit committee experience, the following qualifications led the Board to conclude that Mr. Parker should serve on AAM’s Board: his leadership and financial experience as the Chief Financial Officer of Harman International Industries, Inc. and of ABB; his responsibilities for mergers and acquisitions, information technology, internal audit and tax; the breadth of his management experience over global operating activities, capital allocation structures and developing and implementing strategic plans; and his subject matter knowledge in the areas of finance, investments, audit and accounting, strategic planning, human capital management and risk management. | | | | | | | Age: 65 | Other Public Company Directorships | Directorship (not-for-profit) | Director Since: 2018 | TriMas Corporation since March 2015

Apogee Enterprises, Inc. since May 2018

nVent Enterprises Plc. since May 2018 | –Stamford, Connecticut YMCA | | Committees: | | | Audit | | | Nominating/Corp Gov | | |

| | | | | | | | | | John F. Smith | Principal, Eagle Advisors LLC | | | | | Current and Past Positions | Key Qualifications and Experience | Principal, Eagle Advisors LLC (strategy development and performance improvement consulting) since 2011

Positions at General Motors: Group Vice President, Corporate Planning and Alliances (most recent position) 2000 - 2010 General Manager, Cadillac Motor Car 1997 - 1999 President, Allison Transmission 1994 - 1996 Vice President, Planning; International Operations, Zurich Switzerland 1989 - 1993 | Based on his professional background and prior AAM Board experience, the following qualifications led the Board to conclude that Mr. Smith should serve on AAM's Board: his leadership experience in the automotive industry; the breadth of his management experience with General Motors international operations; and his subject matter knowledge in the areas of manufacturing, finance, innovation and technology, strategic planning, human capital management and risk management. | | | | | | Directorship (not-for-profit) | –Jeremie Rising | Age: 73 | Public Company Directorship | Director Since: 2011 | TI Fluid Systems plc (TI Automotive)

since 2017

| | Committees: | | Audit | Previous Directorships | | Technology (Chair) | CEVA Logistics, AG 2013 - April 2019

Covisint Corporation 2016 - 2017

Arnold Magnetics 2015 - 2016

Plasan Carbon Composites 2013 - 2014

Smith Electric Vehicles Corp. 2012 - 2014 | | Executive | | | |

Class III — Directors to hold office until the 2026 Annual Meeting of Stockholders | | | | | | | | | | James A. McCaslin | Retired President & Chief Operating Officer, Harley-Davidson Motor Co. | | | | | Past Positions | Key Qualifications and Experience | Positions at Harley-Davidson (Retired 2010):

President & Chief Operating Officer 2001 - 2009

Various senior executive positions 1992 - 2001

Other Manufacturing Company Positions:

Manufacturing and Engineering executive JI Case (agricultural equipment) 1989 - 1992

Manufacturing and Quality executive Chrysler Corporation Volkswagen of America General Motors Corporation 1966 - 1989

| Based on his professional background and prior AAM Board experience, the following qualifications led the Board to conclude that Mr. McCaslin should serve on AAM's Board: his leadership experience as President & COO of Harley-Davidson Motor Company; the breadth of his manufacturing and engineering experience at global manufacturing companies; and his subject matter knowledge in the areas of engineering, innovation and technology, manufacturing, human capital management and risk management. | | | | | | | Age: 75 | | Director Since: 2011 | Previous Public Company Directorship | | | Lead Independent Director | Maytag Corporation

2003 - 2006 | | Committees: | | Audit | | Compensation (Chair) | | Nominating/Corp Gov | | Technology | | Executive | | | |

| | | | | | | | | | William P. Miller II CFA | Senior Managing Director - Capital Markets, Investments & Governance

Financial Markets International, Inc. | | | | | Current and Past Positions | Key Qualifications and Experience | Senior Managing Director - Capital Markets,

Investments & Governance since 2020

Senior Managing Director & CFO

2011 - 2013

Financial Markets International, Inc.

Chief Financial Officer

2019 - September 2020

Head of Asset Allocation

2013 - 2019

Saudi Arabian Investment Company

Deputy Chief Investment Officer

Ohio Public Employees Retirement System

2005 - 2011

Senior Risk Manager

Abu Dhabi Investment Authority

2003 - 2005

Independent Risk Oversight Officer & Chief Compliance Officer

Commonfund Group 1996 - 2002

| Based on his professional background and prior AAM Board and Audit Committee experience, the following qualifications led the Board to conclude that Mr. Miller should serve on AAM's Board: his leadership qualities developed from his experience as Head of Asset Allocation and Chief Financial Officer for the Saudi Arabian Investment Company and as an officer with oversight responsibilities for investments, risk and compliance since 1996; the breadth of his experience in serving on the boards of the Chicago Mercantile Exchange and the Dubai Mercantile Exchange; and his subject matter knowledge in the areas of finance, investments, audit and accounting, innovation and technology, regulatory matters, human capital management and risk management. | | | | | | | Age: 68 | Director Since: 2005 | Directorship (not-for-profit) | | Committees: |

–Business Advisory Council College of Business & Economics Ashland University | | Audit (Chair) | Previous Directorships | | Technology | Wayne County (Ohio) Humane Society 2021-2023 Chicago Mercantile Exchange 2003 - 2017

Dubai Mercantile Exchange 2011 - 2017 |

| | | | | | | | | | Sandra E. Pierce | Retired Chair, Huntington Bank Michigan | | | | | Past Positions | Key Qualifications and Experience | Chair, Huntington Bank Michigan and Sr. Vice President, Private Client Group & Regional Banking Director 2016 - 2023

Vice Chair, First Merit Corporation and Chair and Chief Executive Officer, First Merit Michigan (acquired by Huntington Bank) 2013 - 2016

President and Chief Executive Officer, Charter One, Midwest Regional Executive (RBS Citizens, N.A.) 2005 - 2012

Various banking and executive positions with increasing responsibility with JPMorgan Chase, Michigan (successor to Bank One, First Chicago NBD and NBD Bank, N.A.) 1978 - 2005 | Based on her professional background and public company board experience, the following qualifications led the Board to conclude that Ms. Pierce should serve on AAM’s Board: her leadership experience as Senior Executive Vice President - Private Client Group & Regional Banking Director, and Chair of Huntington Bank Michigan, and as chief executive officer of FirstMerit Michigan and Charter One; the breadth of her corporate marketing and community development experience in her professional, civic and charitable endeavors; and her subject matter knowledge in the areas of strategic planning, finance, public relations, business development, human capital management and risk management. | | | | | | | | Directorships (not-for-profit) | –Downtown Detroit Partnership –Business Leaders for Michigan, Vice-Chair –Detroit Economic Club –Detroit Regional Chamber –Henry Ford Health System Foundation –The Parade Company –Wayne State University Foundation | Age: 65 | Other Public Company Directorship | Director Since: 2018 | Penske Automotive Group since 2012 | | Committees: | Private Company Directorships | | Audit | Barton Malow Company

since January 2013

ITC Holding Corp (subsidiary of Fortis, Inc.)

since January 2017 | | Compensation | | |

Corporate Governance Highlights At AAM, we believe that strong corporate governance contributes to long-term shareholder value. We are committed to sound governance practices, including those described below. | | | | | | | | | | Independence | | Accountability | –10 of 11 directors are independent –Lead Independent Director –Committees comprised of only independent directors (except Executive Committee) –Independent directors engage in regular executive sessions | | –Proactive shareholder engagement program –Proxy access by-laws –Majority vote for directors in uncontested elections –Candid Board and committee evaluation process –Commitment to Board refreshment |

| | | | | | | | | | Sound Practices | | Risk Management | –Board policy requires inclusion of diverse candidates, such as women and minorities, in board candidate pool –Nominating/ Corporate Governance Committee oversight of sustainability program and human capital management, including DEI initiatives and succession planning –Stock ownership requirements for directors and executive officers –Hedging or pledging of AAM stock is prohibited –Limitations on other board service | | –Active Board oversight of AAM's overall risk management structure –AAM has robust risk management processes throughout the Company –Individual Board committees oversee risks related to their areas of responsibility –The Board and its committees receive regular updates from management on top enterprise risks and related risk mitigation activities |

Board ResponsivenessSuccession Planning, Diversity and Refreshment Our Board believes that the most effective oversight comes from a Board that represents a diverse range of experience and perspectives that provide the collective skills, qualifications and attributes necessary for sound governance. Consistent with this philosophy and shareholder feedback, Board policy requires that each director search include qualified candidates who reflect diverse backgrounds, including gender and race.

The Board is also committed to Shareholder FeedbackBoard refreshment and believes fresh perspectives from new directors are important to sustaining an energized, strategic Board, when properly balanced with the insight and deeper understanding of our business provided by longer-serving directors.

Consistent with our succession planning objectives and commitment to Board refreshment, the Board appointed Aleksandra Miziolek to our Board as an independent director, effective March 15, 2024, further strengthening our Board’s mix of diverse perspectives.Ms. Miziolek joins the class of directors with a term expiring at the 2025 Annual Meeting of Shareholders. Ms. Miziolek brings to our Board extensive automotive industry, international business, strategic planning, risk management, business development, human capital management, and legal and regulatory experience. See page 16 of this proxy statement for details on the Board’s director candidate recruitment process.

As part of the Board’s annual self-assessment and evaluation process, the Board continues to consider the effectiveness of its composition to ensure it has the appropriate mix of skills, perspective and diversity. As a result, the Board will actively seek opportunities to appropriately refresh our annual shareholder outreach program, we contacted more than 25Board over time. The Nominating/Corporate Governance Committee is actively identifying and evaluating qualified director candidates from diverse backgrounds for consideration as part of our largest shareholders representing approximately two-thirds of outstanding shares. Our CFO and Investor Relations Director led this engagement and discussed the topics described below. Our CFO reported shareholder feedback to the Board for consideration in its decision-making.continual board refreshment efforts.

| | | | | | | | | | | | Shareholder Engagement Topics | | | | | þ | Board involvement in ESG program | þ | Link between ESG performance and incentive compensation | | | | | þ | Diversity, equity and inclusion initiatives | þ | Selection process for Board candidates | | | | | þ | Human capital management | þ | Board oversight of risk | | | | | þ | Board refreshment and diversity | þ | Separation of Chairman and CEO roles | | | | | þ | Shareholder rights | þ | Classified BoardCorporate Governance |

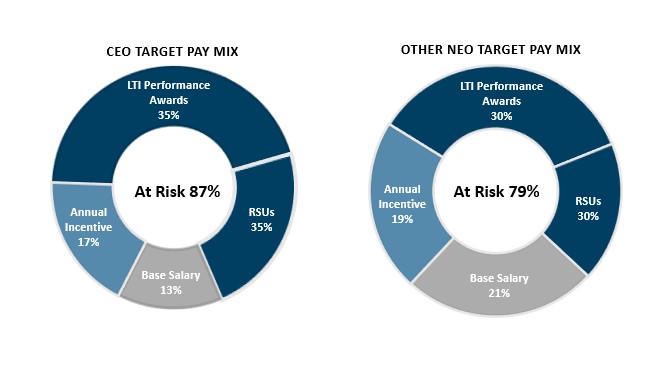

Based on the feedback AAM received during the recent outreach campaign, the Board is acutely aware of shareholder expectations regarding Board oversight of AAM's Sustainability Program. The Board is actively engaged in overseeing AAM's continued progress in advancing critical DEI initiatives and achieving initial environmental goals ahead of schedule. Also in response to shareholder feedback, the Compensation Committee, in February 2022, adjusted the design of AAM's annual incentive program to link a specific percentage of incentive pay opportunities directly to achievement of sustainability-related goals and objectives.

To advance director skills and Board effectiveness, the Board held a special session to focus on building its DEI capabilities and unconscious bias awareness and on promoting conscious inclusion as a Board. The Board will integrate this learning into its deliberations and decision-making and oversight of AAM's efforts to advance a respectful and inclusive culture. We believe these initiatives drive superior performance and are critical to advancing AAM's overall business strategy. Based on their feedback, many shareholders share this view.

Director Independence The Board has adopted Director Independence Guidelines to assist in determining the independence of our directors under the independence standards of the New York Stock Exchange (NYSE). The Director Independence Guidelines are included in AAM’s Corporate Governance Guidelines, which are available on our website at aam.com/investors/governance. The Board annually reviews and determines, on the recommendation of the Nominating/Corporate Governance Committee, whether any director has a material relationship with the Company that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. No director qualifies as independent unless the Board determines that the director has no direct or indirect material relationship with the Company. In February 2022, theThe Board has reviewed the independence of each director, applying the independence standards set forth in our Corporate Governance Guidelines. Based on these independence standards and the relevant facts and circumstances, the Board determined that no director other than Mr. Dauch, our CEO, has a material relationship with AAM and that each director other than Mr. Dauch is independent. Mr. Dauch is not independent because of his employment with AAM.

Board Leadership Structure Our Board consists of a combined Chairman and CEO role, complemented with a Lead Independent Director chosen from our independent directors. This structure, along with sound governance practices, provides effective and independent oversight of the Company. The Chairman and CEO role brings to the Board the experience and expertise of both the Company and the automotive industry. Mr. Dauch's skills and experience are well-suited for the role of Chairman, putting the Board in the best position to identify and assess key industry drivers and changes in the competitive landscape while

determining business strategies. In light of the opportunities and challenges facing AAM, the Board believes that shareholders are best served by having Mr. Dauch serve in the combined role of Chairman and CEO. While our independent directors bring diverse experiences and expertise from various perspectives outside AAM, Mr. Dauch's in-depth knowledge of our business enables him to identify important areas of focus for the Board and effectively recommend appropriate agendas. The combined role of Chairman and CEO facilitates information flow between management and the Board, provides clear accountability and promotes efficient decision making, all of which are essential to effective governance. Lead Independent Director Our Board leadership structure is further enhanced by a Lead Independent Director. The Lead Independent Director plays an important role in our governance structure, working with both the independent directors and the Chairman and CEO to ensure the Company is well positioned with sound strategy, robust risk management and effective governance. The Lead Independent Director's key responsibilities are to:

–preside at executive sessions of independent directors; –call special executive sessions of independent directors, as appropriate; –serve as liaison between the independent directors and the Chairman &and CEO; –inform the Chairman &and CEO of issues arising from executive sessions of the independent directors; and –with Board approval, retain outside advisors who report to the full Board on matters of interest to the Board. Mr. McCaslin currently serves as Lead Independent Director. Board MeetingsSkills and Qualifications Under AAM's by-laws, regular meetingsThe following table summarizes the key qualifications and skills of our Board members that are directly relevant to our business and strategic objectives. The director biographies listed below describe further details about the Board are held at least quarterly. Directors are expected to attend all Board meetings, meetingsqualifications and relevant experience of committees on which they serve,each director nominee and the annual meeting of stockholders. Directors are expected to spend the time needed and meet as frequently as necessary to properly discharge their responsibilities. Overall attendance at Board and committee meetings during 2021 was 96%. All directors then in office attended the 2021 annual meeting of stockholders. All of the directors attended more than 75% of Board and committee meetings on which they served in 2021.

Board Committees

The Board has delegated some of its authority to five committees: the Executive Committee, the Audit Committee, the Compensation Committee, the Nominating/Corporate Governance Committee and the Technology Committee. Each of the Audit, Compensation and Nominating/Corporate Governance Committees has adopted a charter that complies with current NYSE rules relating to corporate governance. Copies of these committee charters are available at aam.com/investors/governance.

Committee membership as of March 24, 2022, the number of meetings held during 2021, and each committee's primary responsibilities are summarized below. Every committee reports on its activities to the full Board.returning director.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Skill / Qualification | David C.

Dauch | Elizabeth A.

Chappell | William L.

Kozyra | Peter D.

Lyons | James A.

McCaslin | William P.

Miller II | Aleksandra A. Miziolek | Herbert K.

Parker | Sandra E.

Pierce | John F.

Smith | Samuel

Valenti

III | Audit CommitteeIndustry Experience | n | n | n | n | n | n | n | n | n | n | n | | CEO/COO Experience | n | n | n | | n | | | | n | | n | | International Business | n | | n | n | n | n | n | n | | n | | | Strategic Planning | n | n | n | n | | | n | n | n | n | n | | Innovation & Technology | n | n | n | | n | n | | | | n | | | Financial Expertise | | | | | | ¢ | | ¢ | n | ¢ | n | | Business Development | n | n | n | | n | | n | n | n | n | n | | Legal/Regulatory | | | | n | | n | n | | | | | | Human Capital Management | n | n | n | n | n | | n | n | | | n | | Risk Management | n | n | n | n | n | n | n | n | n | n | n | | | | | | | ¢ | Audit Committee financial expert under SEC rules |

Nominees for Director Class I — Directors to hold office until the 2027 Annual Meeting of Stockholders | | | | | | | | | | David C. Dauch | Chairman of the Board & Chief Executive Officer, AAM | | | | | Current and Past Positions at AAM | Key Qualifications and Experience | Chairman of the Board

since August 2013

Chief Executive Officer

since September 2012

President & Chief Executive Officer

September 2012 - August 2015

President & Chief Operating Officer

2008 - 2012

Various positions of increasing responsibility

1995 - 2008 | Based on his professional background and prior AAM Board experience, the following qualifications led the Board to conclude that Mr. Dauch should serve on AAM's Board: his leadership experience as an officer of AAM since 1998; the breadth of his management experience within, and knowledge of, AAM's global operations; and his subject matter knowledge in the areas of innovation and technology, manufacturing, strategic planning, human capital management and risk management. | | | | | | Directorships (not-for-profit)

and Leadership Roles | 2021 Meetings: 4

Members:

William P. Miller II (Chair) *

James A. McCaslin

Herbert K. Parker*

Sandra E. Pierce

John F. Smith*

Samuel Valenti IIIAge:59

| Other Company Directorships | –Oversees the independent auditors' qualifications, independenceBusiness Leaders for Michigan –Detroit Economic Club –Detroit Regional CEO Council, Regional Chamber and performanceRegional Partnership –Great Lakes Council Boy Scouts of America –Boys & Girls Club of Southeastern Michigan –National Association of Manufacturers (NAM) –Miami University Business Advisory Council –Stellantis Supplier Advisory Council | Director Since: 2013 (Chairman) 2009 | Amerisure Companies since 2014

| | Previous Directorship | | Horizon Global Corporation

2015 - 2018 | | Committees: | | Executive (Chairman) | | | | | | Previous Directorships (not-for-profit) | | | –OverseesGeneral Motors Supplier Council –Original Equipment Suppliers Association (OESA) –Detroit Mayor's Workforce Development Board –Sustainability Leadership Council of Michigan |

| | | | | | | | | | William L. Kozyra | Chairman & Chief Executive Officer, Wilko Plastics, Inc. | | | | | Current and Past Positions (BF) | Key Qualifications and Experience | Chairman & Chief Executive Officer

Wilko Plastics, Inc. since 2022

President & Chief Executive Officer

TI Fluid Systems plc (TI Automotive) (fluid storage, carrying and delivery systems)

2008 - December 2021

President & Chief Executive Officer

Continental AG North America

1998 - 2008

Member of Executive Board

Continental AG (DAX)

2006 - 2008

Vice President & General Manager

Brake Products Division of

Bosch Braking Systems

1995 - 1997 | Based on his professional background and prior AAM Board experience, the qualityfollowing qualifications led the Board to conclude that Mr. Kozyra should serve on AAM's Board: his leadership experience as Chief Executive Officer of TI Fluid Systems plc; the breadth of his international experience with global companies in the automotive industry; and integrityhis subject matter knowledge in the areas of our financial statementsengineering, OEMs, manufacturing, innovation and technology, strategic planning, human capital management and risk management. | | | | | | | Age:66 | Former Public Company Directorship | Directorships (not-for-profit)

and Leadership Roles | Director Since: 2015 | | Committees: | TI Fluid Systems plc (TI Automotive)

2008 - December 2021 | –General Motors Supplier Council –Ford Motor Company Top 100 Supplier Forum –Notre Dame Preparatory School –Automotive Hall of Fame –Boy Scouts of America, Detroit –University of Detroit Alumni Council –Society of Automotive Engineers | | Compensation | | Nominating/Corp Gov | | Technology | | | | |

| | | | | | | | | | Peter D. Lyons | Counsel, Freshfields Bruckhaus Deringer US LLP | | | | | Current and former Positions | Key Qualifications and Experience | Counsel since 2021 Partner 2014 - 2021 Freshfields Bruckhaus Deringer US LLP New York, NY

Adjunct Professor since 2020 University of Virginia, School of Law | Based on his professional background and prior AAM Board experience, the following qualifications led the Board to conclude that Mr. Lyons should serve on AAM's Board: his experience as an attorney of major law firms since 1980; the breadth of his experience in advising global businesses on complex legal matters and transactions; and his subject matter knowledge in the areas of corporate governance, mergers and acquisitions, international business, human capital management and risk management. | | | | | | | Age: 68 | | | Director Since: 2015 | | | Committees: | | | Compensation | | | Nominating/Corp Gov | |

| | | | | | | | | | Samuel Valenti III | Chairman & Chief Executive Officer, Valenti Capital LLC | | | | | Current and Past Positions | Key Qualifications and Experience | Chairman & Chief Executive Officer Valenti Capital LLC since 2000

Positions at Masco Corporation 1968-2008 President, Masco Capital Corporation 1988-2008

Vice President - Investments Masco Corporation 1974-1998 | Based on his professional background and prior AAM Board experience, the following qualifications led the Board to conclude that Mr. Valenti should serve on AAM's Board: his leadership experience as an executive of Masco for 40 years; the breadth of his management experience in diversified manufacturing businesses; and his subject matter expertise in the areas of strategic planning, finance, economics and asset management, human capital management and risk management.

| | | | | | | Age: 78 | Other Public Company Directorship | Directorships (not-for-profit)

and Leadership Roles

| Director Since: 2013 | TriMas Corporation since 2002 | | Committees: | Previous Directorships | –Business Leaders for Michigan –Renaissance Venture Capital Fund (Michigan) Advisory Board Chairman

| | Audit | Horizon Global Corporation 2015 - May 2018 Masco Capital Corporation 1988 - 2008 | | Compensation | | Nominating/Corp Gov |

Returning Directors Class II— Directors to hold office until the 2025 Annual Meeting of Stockholders | | | | | | | | | | Elizabeth A. Chappell | Former President & Chief Executive Officer, Detroit Economic Club | | | | | Current and Past Positions | Key Qualifications and Experience | Former Owner (co-founder) RediMinds, Inc. 2015 - 2019 President & Chief Executive Officer Detroit Economic Club 2002 - 2017 Executive Vice President, Corporate Communications & Investor Relations Compuware Corporation 1997 - 2001 President & Chief Executive Officer Chappell Group 1995 - 2000 Various executive positions with increasing responsibility with AT&T for 16 years | Based on her professional background and prior AAM Board experience, the following qualifications led the Board to conclude that Ms. Chappell should serve on AAM's Board: her leadership experience as President & CEO of the Detroit Economic Club; the breadth of her community outreach and corporate citizenship experience in her professional, civic and charitable endeavors; and her subject matter knowledge in the areas of investor relations, marketing and communications, business development, human capital management and risk management. | | | | | | | Directorships (not-for-profit) and Leadership roles | Age: 66 | Previous Directorships | –Detroit Economic Club –Detroit Zoo –Michigan Israel Business Accelerator (MIBA) –The Parade Company –International Women's Forum | –OverseesDirector Since: 2004

| Handleman Company 1999 - 2009

Compuware Corporation 1997 - 2002

| | Committees: | | Nominating/Corp Gov | | (Chair) | | Technology |

| | | | | | | | | | Aleksandra A. Miziolek | Retired Chief Transformational Officer, Cooper-Standard Holdings, Inc. | | | | | Current and Past Positions | Key Qualifications and Experience | Operator Advisor Assembly Ventures since 2021

Advisor OurOffice, Inc. since 2021

SVP, Chief Transformation Officer, General Counsel, Corporate Secretary and Chief Compliance Officer Cooper-Standard Holdings, Inc. 2014-2019

Member, Director of the performanceAutomotive Industry Group Dykema Gossett PLLC 1982-2014

| Based on her professional background and public company board experience, the following qualifications led the Board to conclude that Ms. Miziolek should serve on AAM’s Board: her leadership experience as SVP, Chief Transformation Officer, General Counsel, Corporate Secretary and Chief Compliance Officer for Cooper-Standard Holdings, Inc.; the breadth of ourher experience leading transformational initiatives and advising global businesses on complex legal issues in the automotive industry; and her subject matter knowledge in the areas of international business, mergers and acquisitions strategic planning, innovation, human capital management and risk management. | | | | | | Directorship (not-for-profit) and Leadership Roles | –Research Council of Michigan –International Women’s Forum Member –NACD Board Leadership Fellow –MiSide

| | Age: 67 | Public Company Directorships | Director Since: 2024 | Solid Power, Inc. since 2021

Exro Technologies, Inc. since 2023

| | | Previous Directorships | | Tenneco, Inc. 2020-2022 | | | | |

| | | | | | | | | | Herbert K. Parker | Retired Executive Vice President, Harman International Industries | | | | | Past Positions | Key Qualifications and Experience | Harman International Industries, Inc.: Executive Vice President, Operational Excellence 2015 - 2017

Executive Vice President and Chief Financial Officer 2008 - 2014

ABB, Inc. and related ABB companies: Chief Financial Officer, North America 2006 - 2008

Chief Financial Officer, Automation Technologies Division 2002 - 2005

Various finance positions of increasing responsibility throughout Asia, Europe and North America 1980 - 2002

| Based on his professional background and public company board and audit committee experience, the following qualifications led the Board to conclude that Mr. Parker should serve on AAM’s Board: his leadership and financial experience as the Chief Financial Officer of Harman International Industries, Inc. and of ABB; his responsibilities for mergers and acquisitions, information technology, internal audit functionand tax; the breadth of his management experience over global operating activities, capital allocation structures and developing and implementing strategic plans; and his subject matter knowledge in the areas of finance, investments, audit and accounting, strategic planning, human capital management and risk management. | | | | | | | Age: 65 | Other Public Company Directorships | Directorship (not-for-profit) | Director Since: 2018 | TriMas Corporation since March 2015

Apogee Enterprises, Inc. since May 2018

nVent Enterprises Plc. since May 2018 | –Stamford, Connecticut YMCA | | Committees: | | | Audit | | | Nominating/Corp Gov | | |

| | | | | | | | | | John F. Smith | Principal, Eagle Advisors LLC | | | | | Current and Past Positions | Key Qualifications and Experience | Principal, Eagle Advisors LLC (strategy development and performance improvement consulting) since 2011

Positions at General Motors: Group Vice President, Corporate Planning and Alliances (most recent position) 2000 - 2010 General Manager, Cadillac Motor Car 1997 - 1999 President, Allison Transmission 1994 - 1996 Vice President, Planning; International Operations, Zurich Switzerland 1989 - 1993 | Based on his professional background and prior AAM Board experience, the following qualifications led the Board to conclude that Mr. Smith should serve on AAM's Board: his leadership experience in the automotive industry; the breadth of his management experience with General Motors international operations; and his subject matter knowledge in the areas of manufacturing, finance, innovation and technology, strategic planning, human capital management and risk management. | | | | | | Directorship (not-for-profit) | –Jeremie Rising | –Discusses with management the Company's risk assessment and risk management frameworkAge: 73

| Public Company Directorship | –Approves audit and non-audit services provided by the independent auditorsDirector Since: 2011

| TI Fluid Systems plc (TI Automotive)

since 2017

| –Oversees the Company's hedging and derivatives practices

Committees: | *Financial ExpertAudit | –Oversees the Company's ethics and compliance programs

Previous Directorships | | Technology (Chair) | –Oversees the Company's cyber security risk management program, including the business continuity program, and receives quarterly reports by our Chief Information Officer

CEVA Logistics, AG 2013 - April 2019

Covisint Corporation 2016 - 2017

Arnold Magnetics 2015 - 2016

Plasan Carbon Composites 2013 - 2014

Smith Electric Vehicles Corp. 2012 - 2014 | | Executive | | | |

| | | | | | | Corporate GovernanceElection of Directors |

Class III — Directors to hold office until the 2026 Annual Meeting of Stockholders

| | | | | | | | | | James A. McCaslin | | | | | Retired President & Chief Operating Officer, Harley-Davidson Motor Co. | | Compensation Committee | | | Past Positions | Key Qualifications and Experience | 2021 Meetings: 6Positions at Harley-Davidson (Retired 2010):

President & Chief Operating Officer

Members:2001 - 2009

James A. McCaslin (Chair)Various senior executive positions

William L. Kozyra1992 - 2001

Peter D. Lyons

Sandra E. PierceOther Manufacturing Company Positions:

Samuel Valenti III

Manufacturing and Engineering executive JI Case (agricultural equipment) 1989 - 1992

Manufacturing and Quality executive Chrysler Corporation Volkswagen of America General Motors Corporation 1966 - 1989

| –RecommendsBased on his professional background and prior AAM Board experience, the CEO's compensation tofollowing qualifications led the Board and determines the compensation of other executive officers

| –Recommends incentive compensation and equity-based plans to the Board

| –Approves executive officer compensation to ensureconclude that it is designed to drive achievement of AAM's strategy and objectives while considering competitive market practices and shareholder interests

| –Recommends non-employee director compensation to the Board

| –Oversees management's risk assessment of the Company's policies and practices regarding compensation of executive officers and other associates

| | –Evaluates and approves corporate goals and objectives for executive officer compensation and evaluates performance in light of these criteria

| | –Oversees the preparation of the Compensation Discussion and Analysis (CD&A) and produces a Committee report for inclusion in our annual proxy statement

| | |

| | | | | | Nominating/Corporate Governance Committee | | | 2021 Meetings: 4

Members:

Elizabeth A. Chappell (Chair)

William L. Kozyra

Peter D. Lyons

James A.Mr. McCaslin

Herbert K. Parker

Samuel Valenti III

| –Identifies qualified individuals to should serve on AAM's Board: his leadership experience as President & COO of Harley-Davidson Motor Company; the Boardbreadth of his manufacturing and committees

| –Reviews our Corporate Governance Guidelinesengineering experience at global manufacturing companies; and Codehis subject matter knowledge in the areas of Business Conductengineering, innovation and recommends changes as appropriate

| –Oversees succession planning for executive officers and other key executive positions and supports the Board's succession/contingency planning process for the CEO

| –Oversees evaluation of the Board and its committees

| –Reviews committee charters and recommends any changes to the Board

| –Oversees our sustainability program policies, strategies and performance and reviews sustainability/corporate responsibility matters with management

| | – Overseestechnology, manufacturing, human capital management including diversity, equity and inclusion initiatives and succession planningrisk management. | | | | | | | Age: 75 | |

Director Since: 2011 | Previous Public Company Directorship | | | Lead Independent Director | | | Maytag Corporation

2003 - 2006 | Technology CommitteeCommittees: | | Audit | 2021 Meetings: 4

Members:

John F. Smith Compensation (Chair)

Elizabeth A. Chappell

William L. Kozyra

James A. McCaslin

William P. Miller II

| –Advises the Board and management on the Company's strategy for innovation and technology

| –Maintains awareness of market demands for technology advancements relative to product, processes and systems

Nominating/Corp Gov | –Oversees and advises management regarding product, process and systems technologies

Technology | –Reviews technology opportunities as potential ways to increase productivity, efficiency, quality and warranty performance and to support the Company's goals and objectives

Executive | | | –Conducts strategy discussions with the full Board

| –All Board members regularly attend Technology Committee meetings

| | |

| | | | | | | Corporate GovernanceElection of Directors |

| | | | | | | | | | William P. Miller II CFA | | | | | Senior Managing Director - Capital Markets, Investments & Governance

Financial Markets International, Inc. | | Executive Committee | | | Current and Past Positions | Key Qualifications and Experience | Senior Managing Director - Capital Markets,

Investments & Governance since 2020

Senior Managing Director & CFO

2011 - 2013

Financial Markets International, Inc.

Chief Financial Officer

2019 - September 2020

Head of Asset Allocation

2013 - 2019

Saudi Arabian Investment Company

Deputy Chief Investment Officer

Ohio Public Employees Retirement System

2005 - 2011

Senior Risk Manager

Abu Dhabi Investment Authority

2003 - 2005

Independent Risk Oversight Officer & Chief Compliance Officer

Commonfund Group 1996 - 2002

| Based on his professional background and prior AAM Board and Audit Committee experience, the following qualifications led the Board to conclude that Mr. Miller should serve on AAM's Board: his leadership qualities developed from his experience as Head of Asset Allocation and Chief Financial Officer for the Saudi Arabian Investment Company and as an officer with oversight responsibilities for investments, risk and compliance since 1996; the breadth of his experience in serving on the boards of the Chicago Mercantile Exchange and the Dubai Mercantile Exchange; and his subject matter knowledge in the areas of finance, investments, audit and accounting, innovation and technology, regulatory matters, human capital management and risk management. | | 2021 Meetings: 1

Members:

David C. Dauch (Chair)

James A. McCaslin

John F. Smith

| | | | | –Acts on matters requiring Board action between meetings of the full BoardAge: 68

| Director Since: 2005 | Directorship (not-for-profit) | | Committees: |

–Has authorityBusiness Advisory Council College of Business & Economics Ashland University | | Audit (Chair) | Previous Directorships | | Technology | Wayne County (Ohio) Humane Society 2021-2023 Chicago Mercantile Exchange 2003 - 2017

Dubai Mercantile Exchange 2011 - 2017 |

| | | | | | | | | | Sandra E. Pierce | Retired Chair, Huntington Bank Michigan | | | | | Past Positions | Key Qualifications and Experience | Chair, Huntington Bank Michigan and Sr. Vice President, Private Client Group & Regional Banking Director 2016 - 2023

Vice Chair, First Merit Corporation and Chair and Chief Executive Officer, First Merit Michigan (acquired by Huntington Bank) 2013 - 2016

President and Chief Executive Officer, Charter One, Midwest Regional Executive (RBS Citizens, N.A.) 2005 - 2012

Various banking and executive positions with increasing responsibility with JPMorgan Chase, Michigan (successor to actBank One, First Chicago NBD and NBD Bank, N.A.) 1978 - 2005 | Based on certain significant matters, limited by our by-lawsher professional background and public company board experience, the following qualifications led the Board to conclude that Ms. Pierce should serve on AAM’s Board: her leadership experience as Senior Executive Vice President - Private Client Group & Regional Banking Director, and Chair of Huntington Bank Michigan, and as chief executive officer of FirstMerit Michigan and Charter One; the breadth of her corporate marketing and community development experience in her professional, civic and charitable endeavors; and her subject matter knowledge in the areas of strategic planning, finance, public relations, business development, human capital management and risk management. | | | | | | | | Directorships (not-for-profit) | –Downtown Detroit Partnership –Business Leaders for Michigan, Vice-Chair –Detroit Economic Club –Detroit Regional Chamber –Henry Ford Health System Foundation –The Parade Company –Wayne State University Foundation | –All members other than Mr. Dauch are independentAge: 65

| Other Public Company Directorship | Director Since: 2018 | |

Board Oversight of Risk Management

The Board believes that strong and effective internal controls and risk management processes are essential for achieving shareholder value. The Board has oversight for risk management with a focus on the most significant risks facing the Company, including strategic, operational, financial and compliance risks. The Board's risk oversight process builds upon management's risk assessment and mitigation processes, which include an enterprise risk management program, regular internal management disclosure and compliance committee meetings, a global ethics and compliance program and comprehensive internal audit processes.

The Board implements its risk oversight function both as a full Board and through delegation to Board committees, which regularly report to the full Board. The Board has delegated the oversight of specific risks to Board committees that align with their functional responsibilities, as summarized in the table below.

| | | | | | | | Penske Automotive Group since 2012 | Responsible

PartyCommittees: | Primary Areas of Risk OversightPrivate Company Directorships | | Audit | | Barton Malow Company

since January 2013

ITC Holding Corp (subsidiary of Fortis, Inc.)

since January 2017 | Full Board | | Oversees overall risk management function and regularly receives reports from the chairs of individual Board committees on risk-related matters falling within each committee's oversight responsibilities. Also receives reports from management on particular risks facing the Company, including through the review of AAM's strategic plan.Compensation | | | | Audit Committee | | Monitors financial, operational, and compliance risks by regularly reviewing reports by management, Internal Audit, Company advisors and the independent auditors.

Regularly reviews risk management and risk assessment practices and related policies and evaluates potential risks related to internal controls over financial reporting.

Oversees the Company's cyber security and other information technology risks, controls, procedures and programs, including mitigation processes. Receives quarterly reports from the Chief Information Officer on cyber security, data protection and business continuity programs, including AAM's monitoring, auditing, implementation and communication processes, controls and procedures.

Monitors financial risks, including capital structure and liquidity risks, and reviews the policies and strategies for managing financial exposure and contingent liabilities. | | | | Compensation Committee | | Monitors potential risks related to the design and administration of our compensation plans, policies and programs, including our performance-based compensation programs, to promote appropriate incentives that do not encourage executive officers to take unnecessary and/or excessive risks. | | | | Nominating / Corporate Governance Committee | | Monitors potential risks related to our governance practices by, among other things, reviewing succession plans and performance evaluations of the Board and CEO and monitoring legal developments and trends regarding corporate governance practices. | | | | Technology Committee | | Monitors risks associated with the Company's product portfolio and our innovation and technology plans. |

| | | | | | | Corporate GovernanceElection of Directors |

Identifying

Corporate Governance Highlights At AAM, we believe that strong corporate governance contributes to long-term shareholder value. We are committed to sound governance practices, including those described below. | | | | | | | | | | Independence | | Accountability | –10 of 11 directors are independent –Lead Independent Director –Committees comprised of only independent directors (except Executive Committee) –Independent directors engage in regular executive sessions | | –Proactive shareholder engagement program –Proxy access by-laws –Majority vote for directors in uncontested elections –Candid Board and committee evaluation process –Commitment to Board refreshment |

| | | | | | | | | | Sound Practices | | Risk Management | –Board policy requires inclusion of diverse candidates, such as women and minorities, in board candidate pool –Nominating/ Corporate Governance Committee oversight of sustainability program and human capital management, including DEI initiatives and succession planning –Stock ownership requirements for directors and executive officers –Hedging or pledging of AAM stock is prohibited –Limitations on other board service | | –Active Board oversight of AAM's overall risk management structure –AAM has robust risk management processes throughout the Company –Individual Board committees oversee risks related to their areas of responsibility –The Board and its committees receive regular updates from management on top enterprise risks and related risk mitigation activities |

Board Succession Planning, Diversity and Evaluating Director CandidatesRefreshment Our Board believes that the most effective oversight comes from a Board that represents a diverse range of experience and perspectives that provide the collective skills, qualifications and attributes necessary to providefor sound governance. To carry out its responsibilities and set the appropriate tone at the top, our Board is focused on the character, integrity and qualifications of its members, and on the Board's leadership structure and composition. The Nominating/Corporate Governance Committee reviews with the Board the experience and attributes desired for effective governance in our changing industry and evaluates the current Board composition in light of these criteria. Although specific qualifications may vary from time to time, desired qualities and characteristics include:

–high ethical character and shared values with AAM;

–high-level leadership experience and achievement at a policy-making level in business, educational or professional activities;

–breadth of knowledge of issues affecting AAM;

–special competencies, such as financial, technical, international business or other expertise, or industry knowledge;

–awareness of a director's vital role in AAM's good corporate citizenship and corporate image; and

–sufficient time and availability to effectively carry out a director's duties.

The Board as a whole should reflect a balance of knowledge, experience, skills, expertise and diversity that, when taken together, will enhance the quality of the Board’s deliberations and decisions. Consistent with this philosophy theand shareholder feedback, Board adopted a policy to include inrequires that each director search include qualified candidates who reflect diverse backgrounds, including diversity of gender and race.

In addition, for incumbent

The Board is also committed to Board refreshment and believes fresh perspectives from new directors are important to sustaining an energized, strategic Board, when properly balanced with the Nominating/Corporate Governance Committeeinsight and the fulldeeper understanding of our business provided by longer-serving directors.

Consistent with our succession planning objectives and commitment to Board consider attendance, past performance onrefreshment, the Board and contributionsappointed Aleksandra Miziolek to our Board as an independent director, effective March 15, 2024, further strengthening our Board’s mix of diverse perspectives.Ms. Miziolek joins the Board and applicable committees. These factors also were taken into consideration in nominating Ms. Chappell, Mr. Parker and Mr. Smith for re-election as Class IIclass of directors each with a term expiring at the 2025 Annual Meeting of Shareholders. Ms. Miziolek brings to our Board extensive automotive industry, international business, strategic planning, risk management, business development, human capital management, and legal and regulatory experience. See page 16 of this proxy statement for details on the dateBoard’s director candidate recruitment process.

As part of the 2025Board’s annual meeting of stockholders. For Ms. Chappellself-assessment and Mr. Parker,evaluation process, the Board consideredcontinues to consider the gender and racial diversity they bringeffectiveness of its composition to ensure it has the Board. Board composition reflects the Board's commitment to identify, evaluate and nominate candidates who possess personal qualities, qualifications, skills, and diversity of backgrounds, and provide aappropriate mix of tenures that, when taken together, best serve our companyskills, perspective and our shareholders. Diversity in tenure createsdiversity. As a good mix of perspectives. Longer-tenured directors bring a deep understanding of the Company and continuity as new directors join the Board. Newer members bring new perspectives, expertise and diversity asresult, the Board is refreshedwill actively seek opportunities to address changes in the businessappropriately refresh our Board over time. The Nominating/Corporate Governance Committee is actively identifying and evaluating qualified director candidates from diverse backgrounds for consideration as part of our continual board refreshment efforts.